|

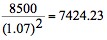

Net present value (NPV) builds on the concept of present value. NPV is the present value of every year for the project added up, starting with the first year and going through the last year. You calculate NPV by performing the present value calculation for each year and then adding those calculations together you get the net present value. In the pizza example you made $10,000 in year three and that $10,000 had a present value of 8162.98. Let’s do the same Present Value calculations for years one and two. You’ve projected the income in year one to be $8000 and in year two to be $8500. Take your year one future value, $8000 and divide divided it by 1 plus the cost of capital at 7% (.07) to determine the NPV. It would look like this:

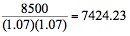

Your year two future value is $8500 divided by 1 plus the 7% cost of capital two times gives you the NPV for year two. It would look like:

Or

Now you have present value totals for the first three years of your business. They are:

Y1: $7476.64

Y2: $7424.23

Y3: $8162.98

To determine the Net Present Value you add those three present values together. Doing so gives you a total of $23,063.85.

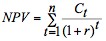

Let’s look at the formula for NPV:

What does each piece mean?

- Σ is sigma. It is used to give you a head’s up that the work that follows will need to be repeated. Literally, it means “sum.” Whatever comes after it, you’re going to calculate multiple times, and then add up all of the results.

- The variables above and below the sigma also tell you something. They let you know that each time you repeat the calculation, you’ll need to use different values Sigma tells you to do a calculation over and over again and then add up the results. How do you know how many times to do the calculation? That’s what the “index” variable (t) and limit (n) tell you.

- The t = 1 beneath the sigma is the year you start your calculations. 1 is year one, but you could start in any year. You might want to know for example how much you will make between years 5 and 10. In that case t would equal 5. • The n above the sigma tells where to stop. It represents the life of the project. So in our pizza example, n= 3. You are calculating NPV over 3 years, adding up the present value of every year’s worth of profit. So, looking at those variables tells you that the present value calculation will need to be done three times…for year 1, year 2, and year 3.

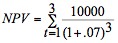

So how would you express the Pizza example using the NPV formula?

|

|

|