|

Looking at future value showed you that money and time are related. The more time passes the less your money is worth. Future value let’s you look ahead and see how much the money you have now will be worth in the future. Present value does just the opposite. Present value lets you look at money in the future and see how much it is worth today. The project you are considering doesn’t have any money now, but it will make money. By calculating its net income, you figured out how much your project will make in the future. Now you need to know the present value of that money, so you can decide if the project is worth it. Will the project bring in enough money to cover the start-up expenses? Will the project be worth the risk? Present value will help you answer those questions. Let’s look and see how it is calculated.

Taking Risk into Account

In the future value calculation, you saw the importance of the interest rate. The interest rate was what you could earn to make your money more valuable in the future. In the present value calculation interest is actually called discount rate or the cost of capital. Instead of representing growth, cost of capital actually represents risk. Cost of capital is the minimum rate of return you must make on an investment.

An Example – Taking out a Car Loan

Let’s look at this in an example you might be more familiar with. You want to buy a car, but don’t have the money, so you have to go to your bank and get a loan. Your bank isn’t going to give you a loan just because you want one. The bank may be willing to take a chance on you, but since they are not sure you will ever pay back everything you borrow; they are going to charge you an interest rate each month.

The bigger the risk the bank feels they are taking, the higher interest rate they charge. A high interest rate means they make more money each month than they would on a less risky car loan. It’s the tradeoff they are willing make, since in the long run they don’t think they’ll ever get all their money back on the risky loan.

To determine how risky you are they are going to decide how likely it is you will be able to pay them back. They will look at how much money you want to borrow, they’ll find out if you have a job, how much you earn, how much you have saved for a down payment and what your credit history is like. When you have borrowed money in the past, have you paid it back?

Once the bank decides how risky you are, they offer you an interest rate on your loan. If your interest rate is low, the bank doesn’t consider you much of a risk. They are pretty confident that you will pay back everything you borrow. But if your rate is high, you are a risk. They want to make as much as they can each month before you stop making your payments.

Cost of Capital works the same way. For-profit hospitals receive the money for major investments from the companies who own them. If the company thinks the project is pretty safe then they’ll set the hospital’s cost of capital low. But if the project is a risk, the company will set the cost of capital high. Just like the bank, they will want to make as much money as they can each month, in case the project fails. There is no hard and fast rule about how cost of capital is set. It is a fairly subjective indicator of how risky the project seems to be.

An Example – Pizza Restaurant

Let’s look at an example. You want to open a pizza restaurant, but you don’t have enough money for all of your up-front costs (like the oven, tables, chairs, and so on), so you ask a bank for a loan. The bank agrees to give you the loan, and they set the cost of capital at 7%. The bank has loaned you $5000.00 to use as start up money. You project that in 3 years your net income will be $10,000. You are a small business and there are several competitors in your area, so the bank felt your business had some risks. They set your cost of capital at 7%. You want to know how much $10,000 is worth in today’s money, so you can make sure it is more than the value of your loan.

When you calculated future value in an earlier step you used the following equation:

Future Value = initial amount x (1 + percentage rate)number if years

When you calculated future value you knew how much money you started with (the initial amount) and the percentage rate and solved for the future value. In the case of present value we know what we end up with and the rate and have to figure out where we started.

Can you use this same equation to work backwards and figure out how much future money is worth today? With a little algebra you can! Click on the Learn More link Equation basics for help solving algebraic equations.

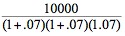

So what do know from the Pizza example to help you figure our present value. You know that the money you will have in 3 years is $10,000 and you know the bank is charging you a cost of capital of 7%. You are starting in the future so instead of multiplying, now you are dividing and remember just like in future value you are working with 107% (1.07) of the total amount. Divide your future value, $10,000 by (1.07) three times because this is the future value of the 3rd year. In other words:

OR

So $10,000 three years from now is worth $8162.98 in today’s money.

Look at the equation more formally:

What does each piece mean?

- Ct is your future amount, in the case of the pizza example $10,000

- r is the cost of capital or the rate you have to make because of how risky your project seems

- t is time, it is the number of years in the future at which you will have the amount Ct

|